From Sign-Up to Support: Which Travel Insurance Won Me Over as a Digital Nomad?

“I’m free to do what I want any old time,” sang the Rolling Stones.

That sentiment perfectly captures the essence of my digital nomad lifestyle – the freedom to explore the world on my terms, to work remotely from sun-drenched cafes or mountaintop retreats.

But just like the Stones knew, even freedom comes with some responsibility.

While you’re out there chasing adventure, it’s crucial to have a safety net in place for unforeseen circumstances. That’s where travel insurance becomes a necessity, providing peace of mind as you embrace the boundless possibilities of the digital nomad world.

However, navigating the world of travel insurance can feel like venturing into a maze. Trust me I’ve hired dozen of travel insurance policies over the years.

It gets complicated very quickly with so many offers between the dozens of providers on the market I’m going to share in this article my method to pick the perfect travel insurance plan for my digital nomad lifestyle.

Step 1 – Understanding My Needs: The Foundation for Choosing Digital Nomad Travel Insurance

Before looking into specific plans and policies, the first step is to understand your individual needs and travel style.

Here are some key factors I consider:

- Trip Duration: Am I embarking on a short weekend getaway or a long-term nomadic adventure? Flexible travel insurance can be purchased for individual trips or as an annual multi-trip plan, depending on my travel frequency.

- Destination: Certain destinations may have higher medical costs or pose a greater risk of specific illnesses. Understanding my destination’s healthcare system and potential risks will help me determine the level of coverage needed.

- Activities: Do I plan on indulging in adventurous activities like hiking, skiing, or scuba diving? Many standard travel insurance plans exclude such activities. I ensure my chosen plan covers my preferred activities for a worry-free experience.

- Remote Work Considerations: As a digital nomad, reliable internet connectivity is crucial to me. While some travel insurance plans might not explicitly cover lost work opportunities due to internet outages, some specialized plans might offer such protection.

Step 2 – What coverage do I need? Building My Ideal Travel Insurance Policy

Now that I have a clearer picture of my needs, I start exploring the essential coverages I need to consider when selecting my travel insurance:

- Medical Expenses: This is arguably the most crucial aspect. I always ensure my plan covers medical emergencies, hospitalization costs, and doctor consultations during my travels. I consider the standard of healthcare at my destination to determine the level of medical expense coverage required.

- Trip Interruption: I don’t want unexpected events like flight cancellations, natural disasters, or political unrest to disrupt my travel plans. Trip interruption coverage helps reimburse prepaid travel expenses in such scenarios.

- Baggage Loss or Damage: I don’t even want to think about what I’d do if my bags get lost or damaged and that’s why I always look for a plan that covers the replacement cost of my belongings in case of such an event.

- Personal Liability: This coverage protects me from financial responsibility in case I accidentally injure someone or damage property during my travels.

Step 3 – Is it the right fit for my lifestyle? Beyond the Basics: Travel Insurance Features Tailored for Digital Nomads

While the core coverages mentioned above are essential, as a digital nomad I might want to benefit from additional features offered by specific travel insurance providers.

Here are some to consider:

- Remote Doctor Consultations: This feature lets me connect with a medical professional virtually, which can be invaluable for accessing healthcare advice while travelling. Especially if I’m travelling to a remote part of the world where I won’t find a specialist doctor locally.

- Gadget Coverage: I don’t joke with my laptops, phones, and cameras as they are my bread and butter. I always consider a plan that covers loss, damage, or theft of my devices.

- Workspace Disruption Coverage: Some plans cover lost work opportunities due to unforeseen circumstances like internet outages or natural disasters affecting my co-working space.

Step 4 – My SafetyWing Success Story: Peace of Mind on My London Adventure.

Now, let’s transition from theory to a real-life experience.

Recently, my wanderlust led me to the captivating city of London for a fundraising conference and to spend so time with my sister. I lived many years in London and I love its history and modern energy. It promised an unforgettable adventure as always with London. And to ensure a worry-free experience, I decided to put SafetyWing’s Nomad Insurance to the test.

Little did I know, this decision would not only offer peace of mind but also pleasantly surprise me with its ease and efficiency.

SafetyWing: My Seamless Experience from Sign-Up to Customer Care

From the very beginning, the process impressed me.

- Simple Sign-Up: The website is incredibly user-friendly, with clear information and straightforward steps. Signing up for the Nomad policy took a matter of minutes, allowing me to get back to planning my London adventure without any hassle.

- No Hidden Clauses: Unlike some other insurance providers, SafetyWing’s policies are transparent and straightforward. There are no hidden clauses or confusing terms, so you know exactly what you’re covered for.

- Responsive Customer Care: During the sign-up process, I had a question about what would happen if I needed to change the dates of my policy coverage. The customer care team was fantastic! Reaching out through their online chat, I was promptly connected with a friendly and knowledgeable representative who addressed my questions. This initial interaction further solidified my confidence in SafetyWing’s commitment to its customers.

SafetyWing’s Nomad Insurance: A Perfect Fit for Digital Nomads

What truly sets SafetyWing apart is that their Nomad Insurance is specifically designed for the needs of digital nomads like myself.

- Flexible Coverage: Their monthly payment plans allow you to tailor your coverage to the specific duration of your trip, providing ultimate flexibility for nomads with ever-changing itineraries. They even cover you if you don’t have a return ticket – which let’s be honest as DN, it often happens.

- Remote Worker Friendly: SafetyWing understands the unique needs of remote workers. Their plans offer coverage for lost work opportunities due to unforeseen events, a concern many traditional travel insurance plans don’t address.

- Worldwide Coverage: As a digital nomad, your work takes you to different corners of the globe. SafetyWing’s Nomad Insurance offers comprehensive coverage **regardless of your destination.

While my London adventure unfolded smoothly, unforeseen circumstances can arise anywhere in the world. A friend of mine is about to go to Bolivia this month and is watching the recent political unrest closely. Medical emergencies, trip disruptions, or even lost luggage can throw a wrench into your perfectly planned itinerary. Having reliable travel insurance in place provides a critical safety net, allowing you to navigate challenges with peace of mind.

More importantly, it’s important to find a provider that understands our unique needs as digital nomads. We want flexibility, affordability and great coverage, ensuring we’re protected without being tied down to a specific travel duration. We want remote work-friendly features and worldwide coverage to cater to our ever-changing itineraries and workspace needs of our nomadic lifestyle.

So, fellow digital nomads, as you embark on your next adventure, ditch the travel insurance anxiety. SafetyWing’s Nomad Insurance offers a seamless and hassle-free experience, allowing you to focus on creating unforgettable memories, exploring new cultures, and embracing the boundless possibilities of the digital nomad world.

PS. Here’s how to get started with SafetyWing’s Nomad Insurance:

- Visit the SafetyWing website (https://safetywing.com/) and explore the different plan options.

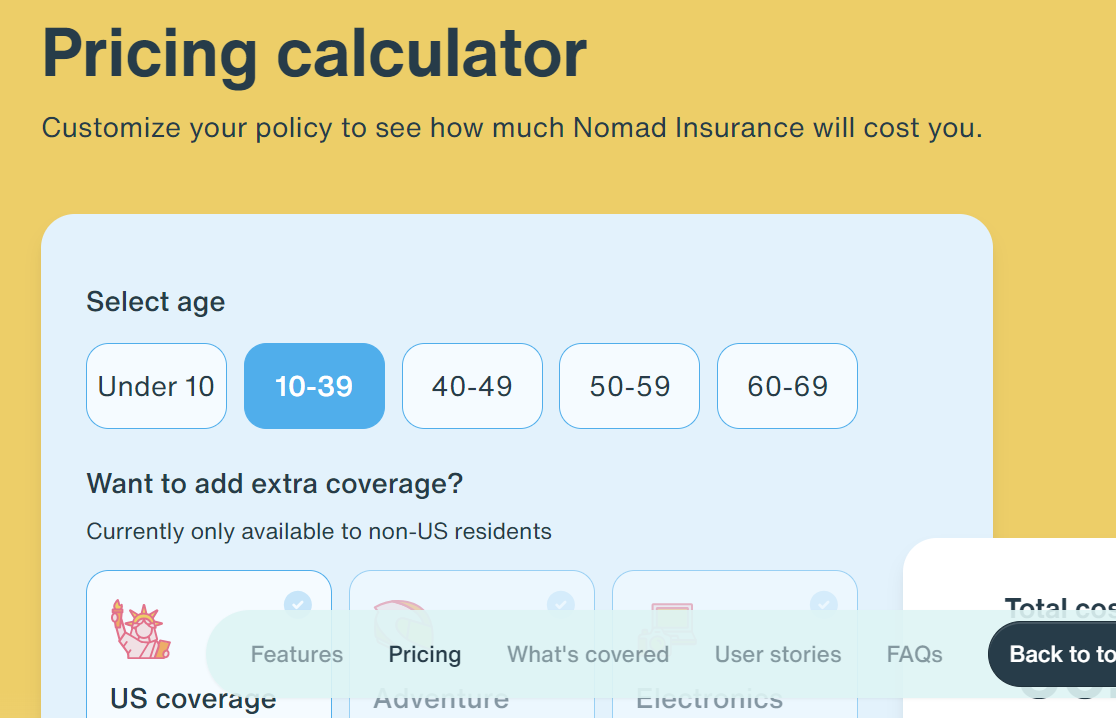

- Choose the Nomad Insurance plan that best suits your needs and travel duration.

- Sign up for the plan and receive your insurance confirmation.

So, what are you waiting for? Start planning your next adventure today!